Momentum is finally returning to the housing market, even if it’s not loud or dramatic. After years of elevated rates and cautious buyers, activity is starting to tick upward. Sellers are coming back. Buyers are testing the waters again. And the pieces are moving toward a healthier market setup for 2026.

It’s not a boom. It’s a reset. And three forces are driving it.

1. Mortgage Rates Are Easing

Rates are still bouncing around, but the broader trend this year has been downward. That shift matters far more than the weekly noise. Recent months have delivered the lowest mortgage rates of 2025, giving buyers a little breathing room.

Freddie Mac’s Chief Economist, Sam Khater, notes that on a median-priced home, today’s rates can mean saving thousands per year compared with earlier this year. That translates directly into buying power.

Redfin data shows a buyer with a $3,000 monthly budget can now purchase roughly $25,000 more home than they could a year ago. That improvement is one reason activity is building again.

2. More Sellers Are Stepping Forward

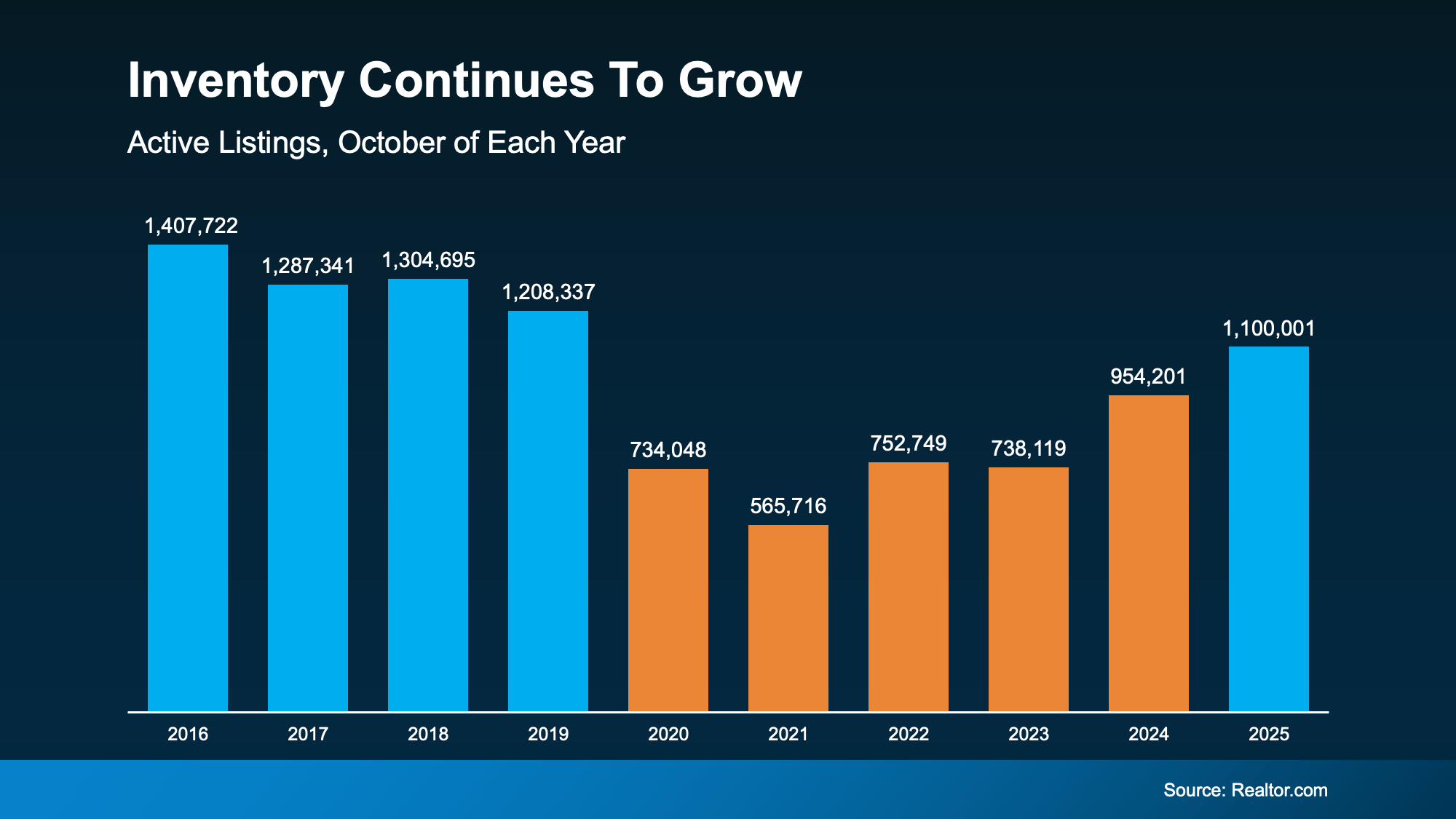

The lock-in effect kept many owners frozen in place, unwilling to trade their low pandemic-era rates for something higher. As rates soften, that grip is loosening. More owners are moving for real-life reasons again, and that’s expanding inventory.

Realtor.com reports that the number of homes for sale has climbed meaningfully and is approaching levels not seen in six years. For buyers, this shift means more choices and a market that’s inching back toward balance.

3. Buyers Are Re-Engaging

With improved affordability and more homes hitting the market, buyers are getting back into the search. The Mortgage Bankers Association is reporting higher purchase application volume year over year, a clear sign that demand is rebuilding.

Forecasters at Fannie Mae, MBA, and NAR all expect moderate sales growth heading into 2026. This isn’t a quick turnaround. It’s gradual, steady improvement.

Bottom Line

After several slow years, the housing market is showing real signs of recovery. Lower rates, more inventory, and rising buyer interest are creating the foundation for a stronger 2026. If you’re thinking about a move, now is a smart time to understand how these trends are playing out in our local market. Let’s talk through your options and build a plan.